The Wirex offers normal bank (visa debit) cards in currencies of USD, EUR and GBP. The way it works is that you can send bitcoins to Wirex accounts, do the exchanges into local currencies account, then spend the cash happily.

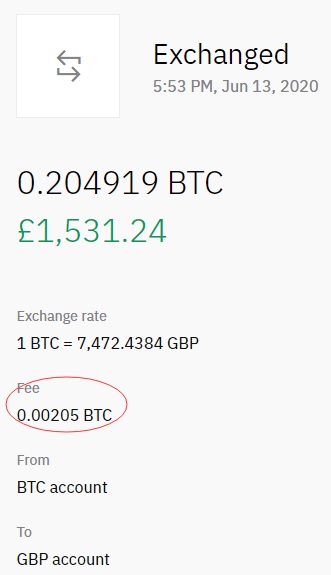

However, when you do the exchanges, it involves an exchange fee 1%.

This can be reduced if you go for the following route.

1. send bitcoins to coinbase – usually a fixed fee 0.0005 BTC.

2. sell the bitcoins to your local currency – usually a smaller fee

3. cash out to paypal (free)

4. send funds from paypal to your bank account (free)

5. send funds from your bank account to Wirex account (yes via the local bank account number)

I managed to save around 50% of fees via this way!

–EOF (The Ultimate Computing & Technology Blog) —

loading...

Last Post: Using the OpenSSL command to Test the SSL Certificate

Next Post: Bruteforce/BackTracking/DFS Algorithm to Split Array into Fibonacci Sequence